Summary: The International Financial Services Centres Authority (IFSCA) introduced regulations in 2022 permitting Foreign Universities to establish International Branch Campuses (IBC) and Offshore Educational Centres (OEC) in GIFT IFSC, marking India’s initiative to create an international education hub within a financial services centre. Foreign universities must meet specific eligibility criteria including ranking within the top 500 QS World University Rankings, proper accreditation in their home country, and demonstrated financial stability, whilst academic offerings are restricted to financial management, fintech, science, technology, engineering, and mathematics.

All courses and degrees offered must be identical to those at the parent entity’s home campus and hold the same recognition and status, ensuring academic parity and quality standards. Set ups would give the IBC’s regulatory freedom from domestic education laws, tax incentives including a 10-year tax holiday, transactions in freely convertible foreign currency, and access to India’s vast student base whilst maintaining non-resident status.

Introduction:

The International Financial Services Centre (“IFSC”) is India’s inaugural financial services hub, situated within the Gujarat International Finance Tec-City (“GIFT IFSC”). In 2022, the International Financial Services Centres Authority (“IFSCA”) introduced regulations permitting foreign higher educational institutions to establish and operate International Branch Campuses (“IBC”)[1] and Offshore Educational Centres (“OEC”) in GIFT IFSC in 2022 (“Regulations”)[2]. These, first of its kind, Regulations were designed to promote GIFT IFSC as an International Education Centre by authorising Foreign Universities (“IBC”)[3] and Foreign Education Institutions (“FEI”)[4] to establish a presence within GIFT IFSC.

Eligibility criteria for Foreign Universities:

Foreign Universities intending to establish an IBC in GIFT IFSC are required to meet specific eligibility criteria, established by the IFSCA, as follows:

- Global Ranking: The IBC must be ranked within the Top 500 in the latest QS World University Rankings (either overall or subject-wise).

- Accreditation & Recognition: The IBC must be duly accredited in its home country to award degrees in permissible subject areas.

- Financial Capability: The IBC must demonstrate financial stability to establish and sustain operations in GIFT IFSC.

- Infrastructure Commitment: The IBC must ensure suitable infrastructure and facilities for delivering courses, including research programmes.

- Representative office: It cannot act as a representative office of the Parent Entity for promotional activities outside GIFT IFSC.

Permitted Subject Areas:

- Financial management;

- Fintech;

- Science;

- Technology;

- Engineering; or

- Mathematics.

Course Recognition & Benefits:

- Identical with Parent Entity: Courses or programmes offered in the GIFT IFSC, as well as the degrees, diplomas or certificates awarded by the IBC must be identical in all respects to those conducted by the Parent Entity at its home campus.

- Same recognition: Degrees, diplomas, and certificates awarded for courses conducted at GIFT IFSC must hold the same recognition and status as those issued by the Parent Entity in its home jurisdiction.

- Course curriculum modification will beallowed with prior approval of IBC’s academic council and after approval from IFSCA.

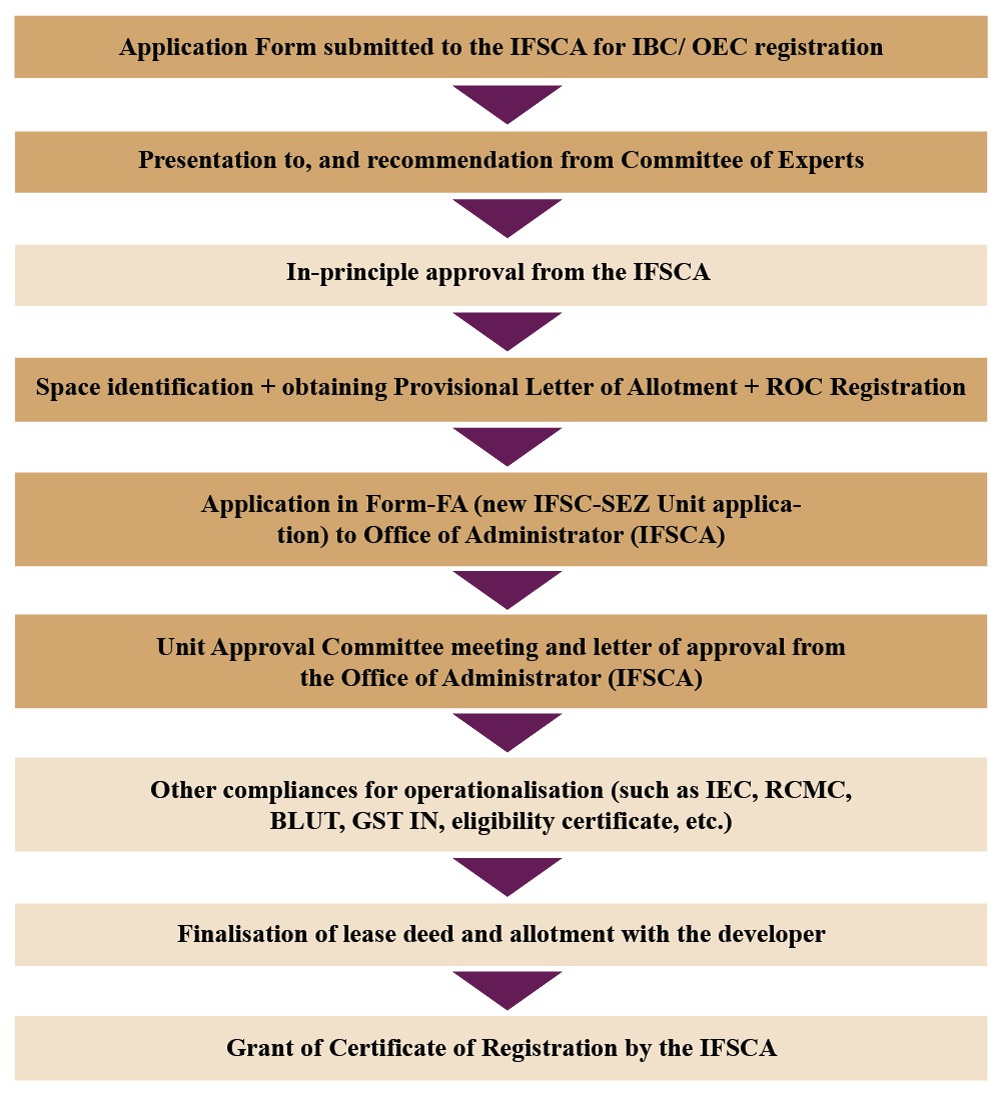

Indicative process for setting up Foreign University in GIFT IFSC:

*Some of the above steps may take place parallelly, before receipt of in-principle approval from the IFSCA, in the interest of time

Other Conditions and compliances:

- Validity of in-principle approval: The in-principle approval is valid for 180 (one hundred eighty) days. The IBC would be required to set up all the required infrastructure and engage necessary manpower, etc. If the IBC is unable to set up within 180 (one hundred eighty) days then an extension application for such period is required to be made to the IFSCA Chairman, at least 7 (seven) days in advance of expiry of such period, for a maximum extension up to 90 (ninety) more days.

- Certificate of Registration (“COR”): IFSCA on being satisfied that the IBC fulfils all the conditions for the grant of registration, may issue a COR with or without conditions.

- Validity of COR: The registration, once granted, is valid for 5 (five) years and renewable for an additional 5 (five) years at a time, with or without any conditions, by the IFSCA.

- Student and faculty selection plan: TheIBC must have identical or similar student and faculty selection plan and process.

- Internal Regulation and Policy: IBC must follow internal regulations and policies for student complaint and grievance redressal as per the approved policy of the Parent Entity.

- Name of IBC: The IBC must operate in GIFT IFSC, using the same or similar name as that of its Parent Entity and conduct activities in accordance with the Parent Entity’s mission, vision and objectives.

- Obligations of Parent Entity: All the obligations of the Parent Entity in its home jurisdiction for the conduct of courses or programmes in any offshore jurisdiction are required to be complied with by the IBC.

- Suspension/ Discontinuation of Course: An IBC cannot discontinue or suspend courses without IFSCA’s prior approval. However, if a course is discontinued, the Parent Entity is expected to offer an alternative arrangement for the affected students.

- Quality Assurance Audit: Quality Assurance Audit report from a recognised Quality Assurance Agency must be submitted by the IBC at the time of the IFSCA Application.

Academic Infrastructure Service Providers in GIFT City:

- Availing Infrastructure Facility: The IFSCA Circular dated December 14, 2023[5], permits the IBC to avail infrastructure services from Academic Infrastructure Service Providers (AISPs), providing built up campus facility, research and development facility, library, laboratories, incubation centres, teaching classroom, and such other related services.

- IBC/ OEC can obtain the following incidental support services from the AISP, if available:

- Campus facility management services;

- Student onboarding, admissions and student welfare services;

- Services for recruitment and management of non-academic staff;

- Branding and marketing services; and/ or

- Payroll services.

Benefits of setting up Foreign Universities in GIFT IFSC:

- Regulatory Freedom: IBC shall operate as per the Regulations specified and are exempt from domestic education laws notified by the University Grants Commission and All India Council for Technical Education, as applicable in India, allowing greater autonomy in curriculum and operations. The courses are expected to be aligned with the regulatory requirements of home regulations, given the courses and recognition are expected to be identical to the home campus.

- Incentives & Benefits: GIFT IFSC provides tax benefits (10-year tax holiday amongst others to facilitate setting up) and financial incentives, making it cost-effective for universities to establish and operate campuses.

- Freely Convertible Foreign Currency: All transactions undertaken by the IBC in GIFT IFSC will occur in specified freely convertible foreign currency only, with certain transactions being permitted in the INR through the Special Non-Resident Rupee Account. Therefore, student fees will be collected in freely convertible foreign currency of the IBC’s choice. This will minimise any forex loss while repatriating monies to the parent company.

- Market Capture: IBC can tap into India’s vast student base, offering globally recognised degrees and attracting top talent, while maintaining their non-resident status.

- Infrastructure Support: IBC can collaborate with Academic Infrastructure Service Providers (AISPs) for specialised support.

- Access to Global Financial Ecosystem: IBC gains proximity to international financial firms, fintech startups, and industry leaders, fostering collaboration and research opportunities. It also gains international recognition and branding, positioning it as a key player in international education.

- Profit Repatriation: The Parent Entity[6] is permitted to repatriate profit, if any, without any restriction, taking home the entire profit from its branch in GIFT IFSC.

Conclusion

Foreign universities establishing campuses in GIFT IFSC benefit from regulatory autonomy and global academic recognition. In addition to the above, IFSCA’s framework ensures quality, parity with parent institutions, and streamlined setup processes. This initiative has opened the doors to India’s vast talent pool, while fostering international collaboration. In line with the above, support from the Academic Infrastructure Service Providers enhances operational efficiency, which also positions GIFT IFSC as a potential strategic hub for global education and innovation in India.

[1] Reg 3 (1) (v) defines “IBC” as a campus set up as a branch by a Foreign University on stand-alone basis, or in such other form as may be permitted by the Authority in the GIFT IFSC for the purpose of delivering courses including research programmes in the permissible subject areas, that are duly accredited under the relevant framework in their respective home jurisdiction, and is registered with the IFSCA

[2] International Financial Services Centres Authority

[3] Reg 3 (1) (iv) defines “FU” as a university established outside India which is duly accredited to award degree for courses including research programmes in the permissible subject areas, within and outside its home jurisdiction.

[4] Reg 3 (1) (iv) defines “FEI” shall as an education institution outside India, which is not a university, and is duly authorized to offer courses including research programmes in the permissible subject areas, within and outside its home jurisdiction.

[5] International Financial Services Centres Authority

[6] Reg 3 (1) (vii) defines “Parent Entity” as the Foreign University or a Foreign Educational Institution that intends to establish and operate an IBC or OEC, as the case may be, in the GIFT IFSC.