Summary: Building on Parts I and II of the IFSC Education Series, (I) Shaping Global Education: Foreign Universities in GIFT IFSC, and (II) Setting up International Branch Campus or Offshore Education Campus in GIFT IFSC, respectively, this third instalment provides a comparative analysis of the regulatory frameworks governing campuses in Mainland India versus those in GIFT IFSC.

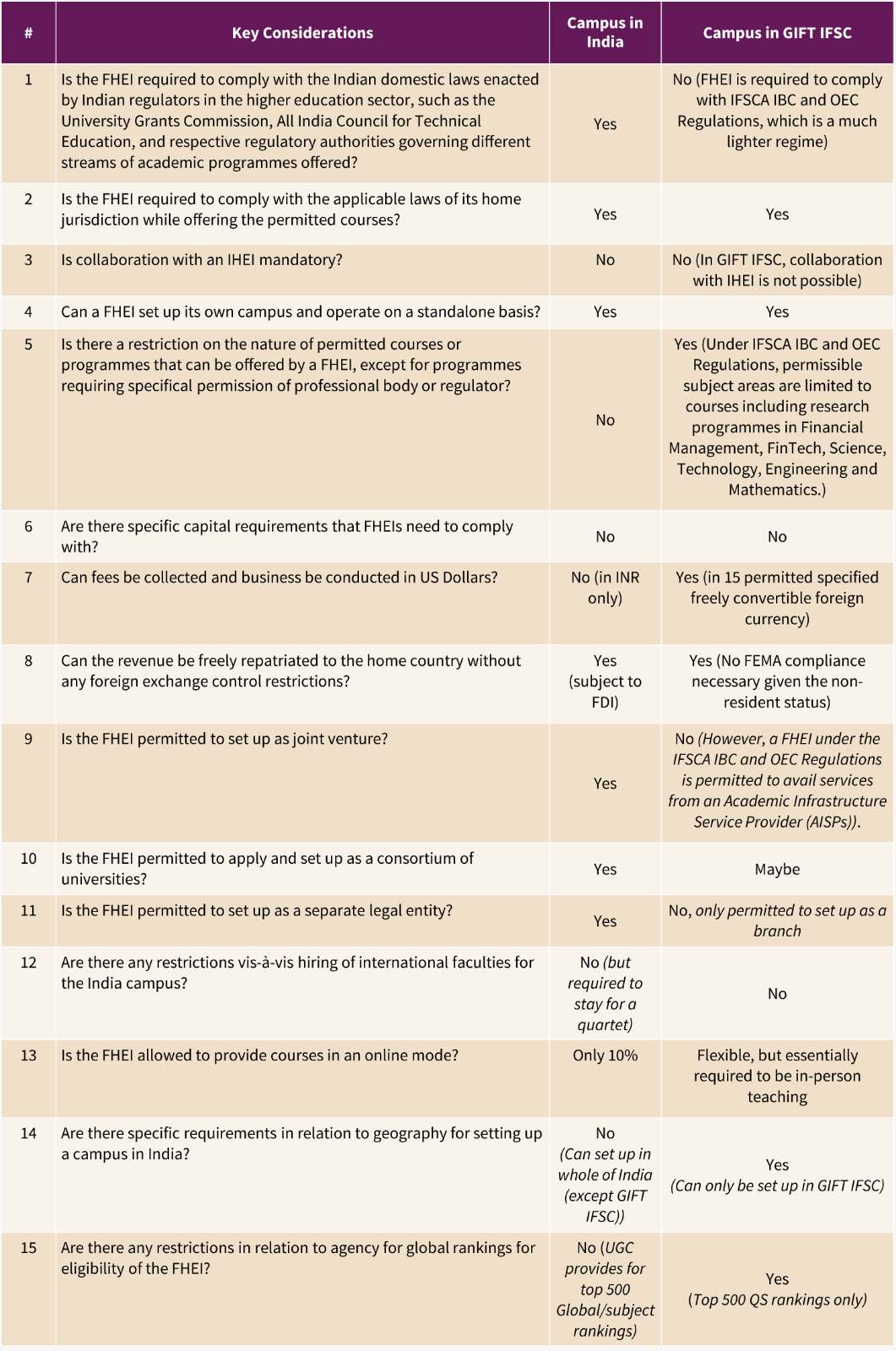

Foreign universities can now establish campuses in India through two pathways: (i) the University Grants Commission (Setting up and Operation of Campuses of Foreign Higher Educational Institutions in India) Regulations, 2023[1] (“UGC FHEI Regulations”) for Mainland India, and (ii) the IFSCA (Setting up and Operation of International Branch Campuses and Offshore Education Centres) Regulations, 2022 (“IFSCA IBC and OEC Regulations”)[2] for campuses in GIFT IFSC. Both regimes permit standalone campuses without mandatory collaboration with Indian institutions, but diverge in regulatory oversight, permissible disciplines, operational flexibility, and financial repatriation norms. This article provides a comparative legal analysis of these frameworks, highlighting critical factors that influence strategic decisions for institutions seeking to enter India’s higher education market.

Introduction

India’s higher education landscape is evolving rapidly, offering foreign universities unprecedented opportunities to establish a physical presence. However, the choice between Mainland India and GIFT IFSC is not merely geographic; it is a strategic decision shaped by contrasting legal, financial, and operational frameworks.

Mainland India, regulated by the UGC, offers broad academic latitude across disciplines. In contrast, as a designated international financial services hub and special economic zone, GIFT IFSC offers a unique regulatory environment that differs markedly from the broader Indian framework.

This article analyses the key legal considerations for foreign universities when selecting an entry route, including eligibility and ranking requirements, entity structuring, programme delivery, and profit repatriation, to equip decision-makers with a clear understanding of the regulatory landscape and its implications on their long-term strategy.

Conclusion

Deciding whether to establish a foreign university campus in Mainland India or GIFT IFSC involves weighing multiple legal and operational factors. Each jurisdiction offers distinct advantages and constraints, and the choice depends on the foreign university’s specific objectives and capabilities.

While Mainland India offers greater flexibility in terms of entity structure, course offerings, and geographic location, it is limited by compliance with Indian domestic higher education regulations. Foreign universities willing to navigate these regulations and seeking to offer a broad range of programmes can establish campuses across India. Examples include the University of Southampton in Gurugram and other approved campuses under UGC FHEI Regulations.

GIFT IFSC, on the other hand, offers a more streamlined regulatory environment. Foreign universities are exempt from Indian domestic education regulations, are allowed unrestricted revenue repatriation, and can establish a for-profit set up. Deakin University and University of Wollongong have already established campuses in GIFT City, while others such as Queen’s University Belfast and Coventry University are in the pipeline. However, since this regime imposes restrictions on entity structure (branch-only), focuses on finance and STEM programmes, and requires compliance with the QS top-500 ranking criteria, for top-tier international universities, particularly for programmes aligned with the financial services and related sectors, GIFT IFSC becomes particularly attractive because of minimal regulatory burden.

To ensure academic integrity and global recognition, both regimes mandate compliance with home-country regulations and policies and require that degrees awarded in India maintain full parity with those offered at the parent campus in a foreign jurisdiction.

Adding to the dynamic regulatory landscape, the IFSCA has released a consultation paper[3] to review the IFSCA IBC and OEC Regulations, inviting comments by December 31, 2025. This presents a unique opportunity for foreign universities to engage at a policy level, influence future norms, and ensure that the framework reflects global best practices while supporting their operational needs.

Foreign universities must carefully assess their strategic priorities, target student demographics, programme offerings, and operational preferences when choosing between these two jurisdictions. India’s higher education market is at an inflection point. By understanding jurisdictional nuances and leveraging opportunities for regulatory engagement, foreign universities can position themselves for long-term success in one of the world’s fastest-growing education ecosystems.

[1] UGC FHEI Regulations, available here: Regulations.pdf

[2] IFSCA IBC and OEC Regulations, available here: International Financial Services Centres Authority

[3] ViewFile – IFSCA (IBC & OEC) Regulations – Consultation Paper