Summary: SEBI has introduced new Amendment Regulations and a CIV Circular allowing Category I and II AIFs to offer co-investment opportunities through Co-investment Schemes (CIV schemes). This provides an alternative to the existing Co-investment Portfolio Manager route under PMS Regulations. The new framework addresses limitations like additional registration costs and investor profile concerns. Key features include restriction to accredited investors only, separate schemes per investment, and specific investment restrictions. While enhancing operational ease for AIFs, the framework introduces compliance layers that may impact deal execution timelines and feasibility for smaller transactions.

Introduction

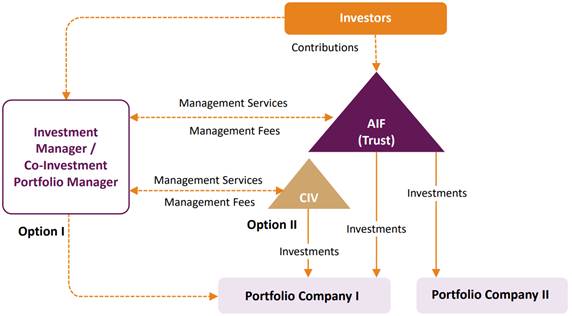

The Securities and Exchange Board of India (“SEBI”) has recently[1] issued SEBI (Alternative Investment Funds) (Second Amendment) Regulations, 2025 (“Amendment Regulations”), and a Circular permitting co-investments through special vehicles, under AIF Regulations (defined herein below) (“CIV Circular”),[2] to enhance co-investment framework for Category I and Category II Alternative Investment Funds (“AIFs”). Co-investment under the SEBI AIF regime can now be undertaken either through (i) a co-investment scheme (“CIV scheme”) launched under the SEBI (Alternative Investment Funds) Regulations, 2012 (“AIF Regulations”), or (ii) the existing regime governing Co-investment Portfolio Managers as specified under the Securities and Exchange Board of India (Portfolio Managers) Regulations, 2020 (“PMS Regulations”).[3] SEBI’s underlying objective for this amendment is to enhance ease of doing business for AIFs and their investors.

Background

“Co-investment” under the Amendment Regulations means “investment made by a manager or sponsor or investor of a Category I or II Alternative Investment Fund in unlisted securities of investee companies where such a Category I or Category II Alternative Investment Fund makes investment.”[4] Prior to the Amendment Regulations, co-investments could be facilitated only by Co-investment Portfolio Managers registered under PMS Regulations (“CPMS Route”), which was subject to certain limitations, some of which have been resolved through the introduction of the CIV Circular, as summarised below:

- Additional SEBI registration: Seeking additional SEBI registration as a Co-investment Portfolio Manager adds to the cost of operations and investments. This issue gets resolved through the introduction of CIV scheme structure for which lower regulatory fees are prescribed.

- Investor limit and profile for unlisted companies: Investee companies are sometimes sensitive to both the investor profile and the number of investors (due to private placement norms)[5] directly participating on their Cap-table. The documentation becomes cumbersome for the investee company with multiple co-investors and delays in timely closing of transactions as each co-investor will follow their own process of documentation closure. This limitation of CPMS Route also gets addressed through the introduction of the CIV scheme structure.

Introduction of the Co-investment structure in addition to the existing CPMS Route

Category I and Category II AIFs (except Angel Funds, which are registered with SEBI on or after September 8, 2025)[6] are now allowed to offer co-investment opportunities within the AIF structure by launching CIV scheme.

CIV scheme under the Amendment Regulations means “a scheme of a Category I or Category II Alternative Investment Fund, which facilitates co-investment to investors of a particular scheme of an Alternative Investment Fund, in unlisted securities of an investee company where the scheme of the Alternative Investment Fund is making investment or has invested”[7].

Key features of Co-investment scheme[8]:

- Only accredited investors can invest in a CIV scheme. Non-accredited investors may follow the CPMS Route for co-investment.

- A shelf placement memorandum shall be filed with the SEBI through a merchant banker, along with the specified fee of INR 1,00,000, prior to offering co-investment opportunities to investors. The PPM shall contain details pertaining to the scheme structure, principal terms and conflicts of interest. For other details, reference of the main fund PPM can be provided.[9]

- Separate CIV scheme shall be launched for each co-investment separately, in accordance with the shelf placement memorandum filed with SEBI. Assets of each CIV scheme shall be ring fenced from assets of other schemes.[10]

- Investment Restrictions:

- A CIV scheme shall not invest in units of alternative investment funds.

- Co-investment by an investor in an investee company shall not exceed three times its contribution made to the main scheme AIF for the AIFs’ investment in such investee company. The following investors are exempted from the said condition:

- Multilateral or Bilateral Development Financial Institutions;

- State Industrial Development Corporations;

- Entities established or owned or controlled by the Central Government or a State Government or the Government of a foreign country, including Central Banks and Sovereign Wealth Funds.[11]

- Co-investment cannot be made by the CIV scheme if:[12]

- it would lead to its investors acquiring or holding an interest/ exposure in an investee company indirectly, that they cannot acquire or hold directly

- it would necessitate additional regulatory disclosure if they had invested directly,

- where the investee company cannot receive investments from such investors directly.

- Ambiguity in allocation of expenses: The CIV Circular provides that“Any expenses associated with Co-investment shall be shared proportionately between the scheme of the AIF and CIV scheme in the ratio of their investments.”[13] It seems that SEBI intends to provide that deal level expenses would be divided between the AIF and the CIV proportionately, however, there is a drafting ambiguity in the CIV Circular that may lead to varying interpretations.

- No borrowing/ leverage: CIV scheme shall not borrow funds directly or indirectly or engage in any kind of leverage..[14]

- Excused/ excluded/ defaulting investors of the main AIF scheme, pertaining to investment in an investee company, are not allowed to co-invest in such investee company.[15]

- Pro-rata rights: Interest of investors of the CIV scheme shall be pro rata to their capital contribution in the CIV scheme, except specified carried interest recipients.[16]

- ‘More favourable terms’ and timing of exit: Akin to the conditions provided in the CPMS Route, the terms of co-investment in an investee company shall not be more favourable than the terms of investment in an AIF, provided that the timing of exit from the co-investment in an investee company is identical to the exit of the scheme of the AIF.

- Winding up of CIV scheme: The CIV scheme shall be wound-up on exit from the co-investment.

- Exemptions under AIF Regulations: CIV scheme is specifically exempted from the following restrictions under the AIF Regulations:

- Maintaining minimum corpus;

- Continuing interest to be maintained by the manager/ sponsor;

- Template of the PPM;

- Requirements pertaining to filing the PPM at least 30 days prior to launch and declaration of first close within 12 months;

- Tenure of AIFs;

- Certain requirements under Regulation 15 of the AIF Regulations, viz: overseas investment restrictions by the RBI and SEBI, investment concentration norm per investee company, etc.

- Compliance Test Report to be filed by all AIFs must contain compliances with the provisions of the CIV Circular.

Key limitations of the amended structure:

- The framework is limited[17] to accredited investors only, as defined under the AIF Regulations, which includes specific net worth and income thresholds[18]. Non-accredited investors cannot participate in the CIV scheme, which may limit participation from certain categories of investors who may not wish to undergo or maintain the prescribed accreditation status.

- The manager must incur additional costs[19] for registration, compliances, operations (separate bank and demat account)[20] and administrative efforts for filing of scheme by preparing a shelf placement memorandum and seeking merchant banker certification each time a co-investment opportunity arises.

- The limitations on quantum of co-investment, terms of co-investment and timing of exit restrict the true potential of co-investments.[21]

- The current framework limits co-investment opportunities to be offered only to existing investors of the main AIF.[22]

- The new framework may increase regulatory interface and elongate deal timelines.

Practical ambiguities to be navigated:

- The implications of transfer, transmission, or mandatory exit of units from the main AIF scheme and its corresponding impact on the associated CIV scheme, creating potential operational uncertainties.

- Procedure for filing the shelf placement memorandum with SEBI (deemed approval/ intimation to SEBI).

Conclusion

SEBI’s Amendment Regulations and CIV Circular represent a regulatory advancement that addresses critical limitations of the CPMS Route, while establishing structured pathways for co-investment through CIV schemes, demonstrating SEBI’s commitment to maintaining investor protection standards while enhancing operational ease for AIFs. While co-investment decisions should ideally be commercial choices between sophisticated parties, the CIV Circular introduces practical considerations that may impact deal execution. The requirement for accredited investors only, mandatory shelf placement memorandum filing through merchant bankers, and separate CIV scheme per investee entity create compliance layers that may deter smaller transactions and potentially elongate deal timelines that may render this route unfeasible. We await the industry response as well as further guidelines by the Standard Setting Forum of the AIFs that may make the CIV route more lucrative for stakeholders.

[1]vide notification No. SEBI/LAD-NRO/GN/2025/265 dated September 8, 2025.

[2]Vide circular No. SEBI/HO/AFD/AFD-POD-1/P/CIR/2025/126 dated September 9, 2025.

[3] Paragraph 1 of the CIV Circular

[4] Regulation 3(I)(i) of the Amendment Regulations.

[5] Under Section 42 of Companies Act, 2013 read with Rule 14 of Companies (Prospectus and Allotment of Securities) Rules, 2014, the private placement norms cap the number of investors to “not more than 200 in aggregate in a financial year”.

[6] Paragraph VI of Amendment Regulations.

[7] Regulation 3(I)(ii) of Amendment Regulations.

[8] Paragraph IV of Amendment Regulation.

[9] Paragraph 2.2 of the CIV Circular

[10] Paragraph 2.3 of the CIV Circular

[11] Paragraph 2.4 of the CIV Circular

[12] Paragraph 2.6 of the CIV Circular

[13] Paragraph 2.9 of the CIV Circular

[14] Paragraph 2.7 of the CIV Circular

[15] Paragraph 2.5 of the CIV Circular

[16] Paragraph 2.8 of the CIV Circular

[17] Paragraph IV of Amendment Regulation.

[18] Regulation 2(1)(ab) of AIF Regulations.

[19] Registration fee of INR 100,000 provided under Schedule II referenced under Paragraph IV of Amendment Regulation.

[20] Paragraph 2.3 of the CIV Circular

[21] Paragraph IV of Amendment Regulation.

[22] As provided in the definition under Regulation 3(I)(i) of the Amendment Regulations